Last Updated: July 18, 2025

Updated by: Marvin Lester Negosa

How Can You Ensure the Effectiveness of Internal Audit?

Internal audits are often misunderstood as routine compliance tasks. But for forward-looking organizations, they offer something far more valuable: clarity, accountability, and insight that drive better decisions.

Whether you’re managing a nonprofit, startup, or growing enterprise, an internal audit done right can reveal risks before they become problems and opportunities before they’re missed. So, what makes an internal audit effective?

Let’s explore the practices, principles, and processes that make internal audits effective, ethical, and aligned with your business goals.

Key Takeaways

- Internal audits evaluate controls, governance, and risk systems to strengthen operations.

- Communication between management, auditors, and the audit committee ensures alignment and transparency.

- Clear audit reporting helps stakeholders understand issues and act swiftly.

- Ethical conduct is essential—integrity, confidentiality, objectivity, and competency must guide the auditor's work.

- Management responses should be timely, specific, and accountable to close the loop on findings.

What Is an Effective Internal Audit?

According to the International Professional Practices Framework (IPPF) by The Institute of Internal Auditors, internal auditing is an independent, objective assurance and consulting activity designed to improve an organization’s operations.

But let’s go beyond the textbook. Effective internal audits are to:

- Follow a structured, risk-based approach.

- Evaluate not only compliance, but also performance, control efficiency, and process resilience.

- Anchored in independence, objectivity, and ethical practice.

- Produce actionable insights that management can implement.

- Involve stakeholders from planning to reporting.

In other words, it follows a systematic approach to evaluate internal controls, governance, and risk management systems. But the true effectiveness of internal audit lies not just in procedures—it depends on open communication, transparent reporting, management accountability, and strict adherence to ethical standards.

When conducted properly, internal audits help prevent fraud, enhance controls, improve efficiency, and support informed strategic decision-making.

Why Open Communication Throughout the Audit Process Is Critical?

Effective communication is the backbone of any successful internal audit. Without full cooperation between the internal audit team, management, and the audit committee, even the best audit procedures can fall short.

Here's what effective collaboration looks like:

- Management’s Role – The management must provide the internal audit team with access to all relevant information, records, and personnel. Withholding data, even unintentionally, can result in missed risks and incomplete conclusions. Transparent engagement ensures the audit team fully understands the operational context.

- Audit Committee’s Role – The audit committee shouldn’t just review reports—they should help shape them. Proactively setting audit objectives, checking on the chief audit executive’s work, and resolving conflicts early leads to a more focused and aligned audit effort.

Any roadblocks or concerns must be addressed promptly, not left for post-audit analysis. An ongoing dialogue, not just formal meetings, creates a stronger internal control environment.

Turning Audit Observations Into Action: Reporting Effectively

The value of internal audits lies not just in what’s uncovered, but in how findings are communicated and addressed. A high-quality audit report can motivate swift corrective action, while a vague or delayed report can lead to inaction and recurring problems.

Here’s how effective internal audit reporting should be done:

- Keep It Clear and Concise – A good audit report is objective, direct, and free of unnecessary jargon. Readers—especially senior executives—should be able to quickly understand the core issues, risks, and recommendations.

- Avoid Misinterpretations – Misunderstandings can dilute the audit’s impact. Avoid overly technical language and clearly explain any control deficiencies or process issues. Provide context for non-audit stakeholders who may not be familiar with accounting or risk management terms.

- Timely Dissemination – Speed matters. The audit report should be disseminated as soon as possible to give management time to act while the findings are still relevant. Prompt feedback also strengthens the accountability loop.

Therefore, the best internal audit reports are clear, direct, and designed for action. They highlight the most critical findings upfront, connect them to business risks, and provide practical recommendations. Instead of relying on dense jargon, they explain issues in a way that resonates with decision-makers.

Addressing Complex or Sensitive Audit Findings

Some audit issues are straightforward—a missing control, an outdated policy, a data entry error. But others can be far more complex, involving disagreements in financial judgment or concerns about ethical boundaries.

These matters should be discussed with the audit committee before finalizing the report:

- Disagreements Over Financial Reporting – If the auditor and management disagree on how certain matters are reflected in the financial statements, it must be discussed thoroughly. These discussions should happen before report issuance and should focus on facts, not personalities.

- Concerns About Accounting Practices – If internal auditors believe the company’s accounting practices involve bias or aggressive estimates, they must flag this to the audit committee. Even if technically compliant, practices that lack transparency or stretch assumptions can mislead stakeholders.

Transparent discussion and timely escalation of these issues help audit committees fulfill their governance responsibilities. They also reinforce the independence and credibility of the internal audit function. By addressing these issues openly, the audit committee fulfills its fiduciary responsibility while strengthening audit credibility.

Management Response: What Happens After the Audit?

The real test of an internal audit’s value happens after the report is issued. Audit findings are only useful if they lead to action. The internal audit team must track whether management responds effectively—and in writing—to each key finding.

Here’s what that response should include:

- A clear commitment to address each issue

- Specific corrective actions with accountable owners

- A realistic timeline for resolution

This response should be tracked and revisited in follow-up audits or risk reviews. The internal audit team must remain engaged to ensure that controls are improved, not just planned.

The Role of Ethics in Internal Auditing

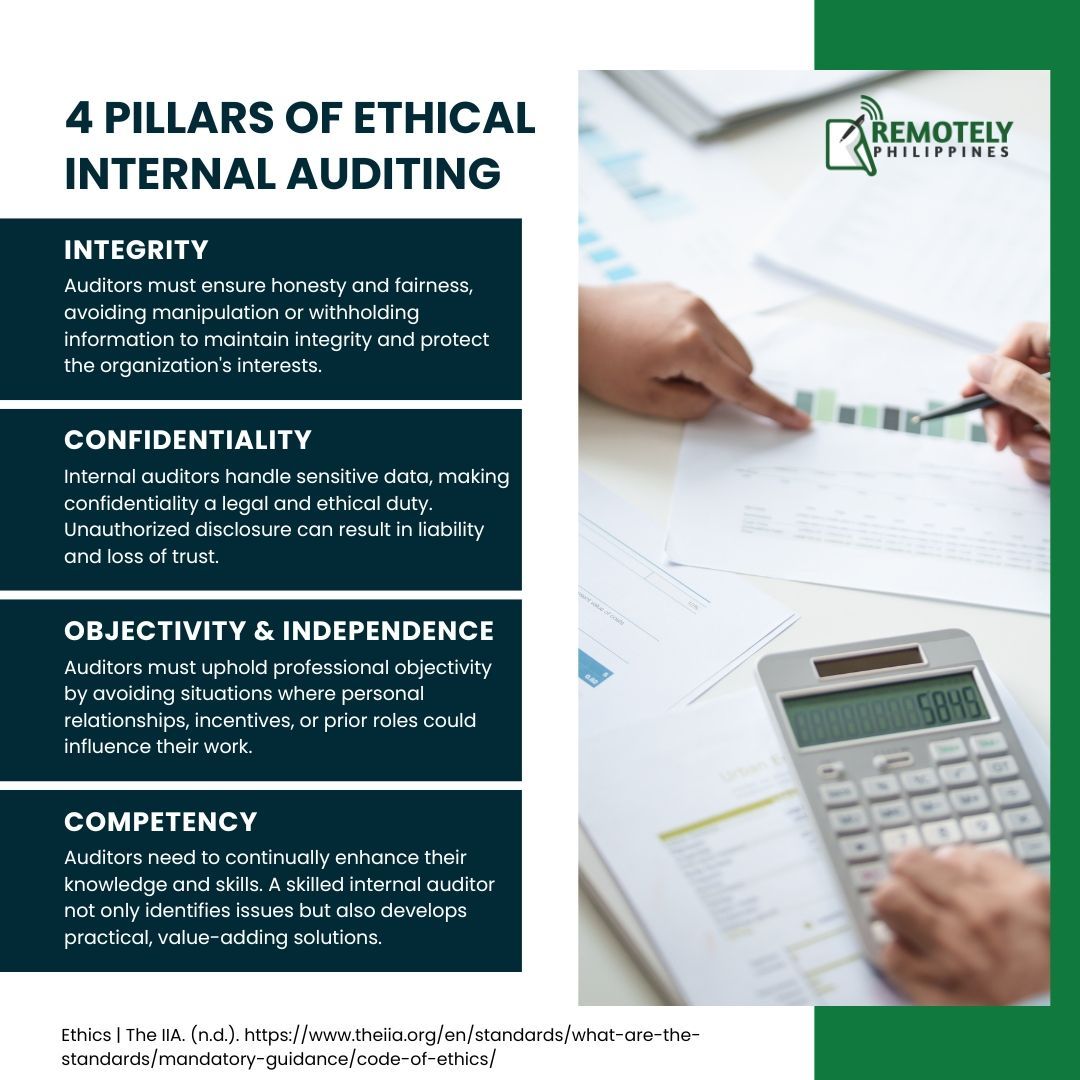

You can have the most technically sound audit function in the world, but if it lacks ethical grounding, it won’t earn the trust or influence it needs. The Institute of Internal Auditors’ Code of Ethics provides a solid foundation.

It outlines four key principles that define ethical internal auditing:

- Integrity - Auditors must act with honesty and fairness, and never manipulate findings or withhold inconvenient facts. This protects both the audit’s reputation and the organization’s interests.

- Confidentiality - Internal auditors are often exposed to sensitive data. Upholding confidentiality is a legal and ethical responsibility—disclosure without proper authority can lead to liability and mistrust.

- Objectivity and Independence - Auditors must maintain professional objectivity. They should avoid situations where personal relationships, incentives, or prior roles in the company could bias their work.

- Competency - Auditors must continuously update their knowledge and skills. A competent internal auditor doesn’t just spot problems—they help design practical, value-adding solutions.

Ethics aren’t just principles, rather protections. They shield the audit from bias and protect the business from preventable harm. When ethics guide every step of the audit, trust grows both internally and externally.

List of Services

-

What makes an internal audit effective?List Item 1

An effective internal audit is one that is objective, well-communicated, actionable, and aligned with organizational goals. It leads to measurable improvements and supports sound decision-making.

-

Who should oversee the internal audit function?List Item 2

The audit committee typically oversees the internal audit function. They help set objectives, monitor progress, and ensure independence from management.

-

How often should internal audits be conducted?List Item 3

The frequency depends on the size, complexity, and risk profile of the organization. Many companies conduct internal audits quarterly or annually, while high-risk areas may be reviewed more frequently.

-

What are common challenges in internal audits?List Item 4

Challenges include lack of access to information, management resistance, scope limitations, and unclear reporting. Ethical concerns and independence issues can also undermine audit quality.

-

Can outsourced teams handle internal audit functions?

Many organizations outsource internal audits to specialists who bring experience, independence, and scalability. It’s a smart move for growing companies that lack internal resources.

Why This Matters for Growing Companies

It’s a common misconception that internal audits are only for big corporations. In reality, small and medium-sized businesses may benefit even more. Smaller organizations often have limited staffing, overlapping roles, and informal processes.

These factors increase the risk of error or fraud, not because people are dishonest, but because proper controls may not be in place. Audits provide structure and discipline, helping leaders see blind spots and make data-driven decisions. For growing businesses, this kind of insight is essential for scaling without chaos.

For nonprofits, where accountability to donors and regulatory bodies is paramount, internal audits are a key part of maintaining trust and funding. Whether conducted in-house or through a trusted outsourcing partner, internal audits bring measurable value, especially when customized to the size, structure, and strategy of the organization.

Final Thoughts

Internal audits don’t just protect businesses—they shape them. Done well, they reveal vulnerabilities, validate strengths, and build the confidence leaders need to move forward. But effectiveness doesn’t happen by accident. It takes clear communication, timely reporting, ethical execution, and serious follow-through.

If your internal audits feel more like a formality than a tool for growth, it may be time to rethink your approach. Remotely Philippines empowers organizations with accurate financial data, streamlined accounting processes, and audit-ready reports.

Our services help clients identify trends, detect risks early, and make sound financial decisions, key ingredients that support an effective internal audit function.

Let’s discuss how we can help optimize your financial reporting and support your next audit cycle, without the overhead. Schedule our meeting today.

Sign up for our newsletter

Get regular curated content on management, outsourcing, and everything you need to know to stay ahead of the curve.